Cost of Goods Manufactured Formula

The cost of goods manufactured COGM is an accounting term that refers to a statement showing a companys total production costs within a specific period. What is Cost of Goods Manufactured COGM.

Cost Of Goods Manufactured Formula Examples With Excel Template

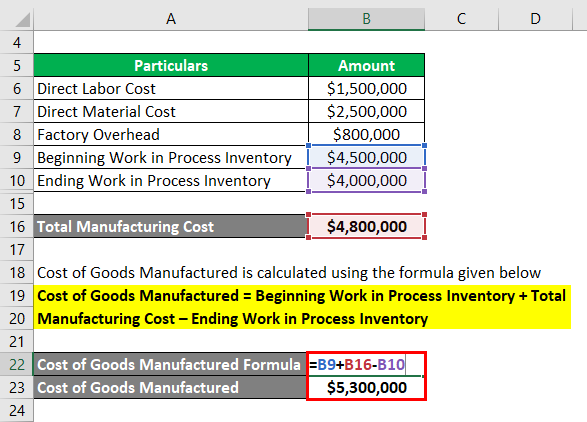

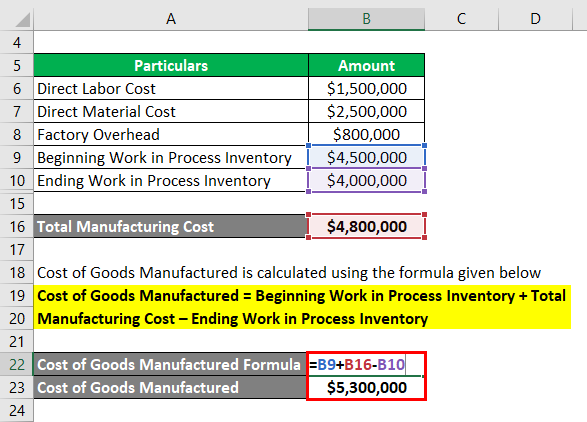

Calculate the cost of goods manufactured.

. The Silk ends the year with 30000 ending work-in-process inventory. It is the best way to maximize the profitability of a. COS Opening Stock Purchases Closing Stock.

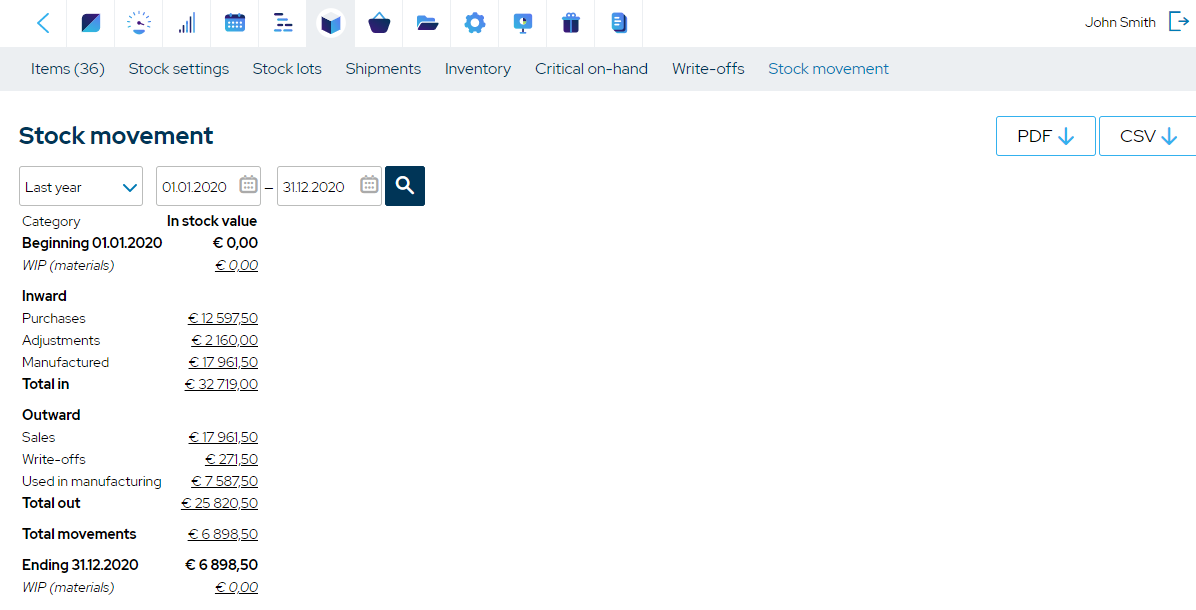

To make informed decisions and to keep track of your companys profitability. Ending Work in Progress WIP 46 million. The cost of goods.

Importance of Cost of Goods. Cost of goods manufactured formula helps maintain a businesss budget and helps identify production-related problems. The cost of goods manufactured COGM is a calculation that is used to gain a general understanding of whether production costs are too high or low when compared to revenue.

Understanding your company starts with an understanding of your companys costs. COS 50000. ABC Furniture Store calculates its cost of goods manufactured for the year as.

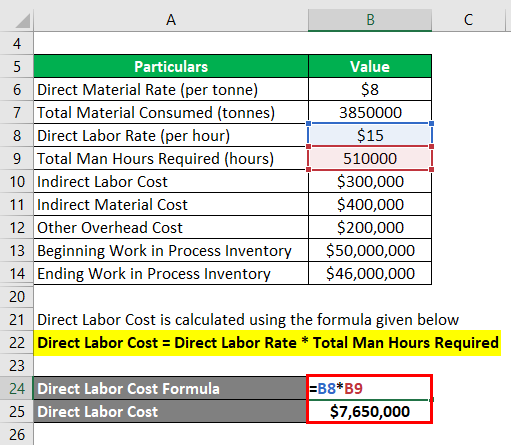

One manufacturers finished goods inventory may be a retailers merchandise inventory dropshipping inventory or another manufacturers raw material or component. The costs for manufacturing these parts are. If we enter those inputs into our WIP formula we arrive at 44 million as the cost of goods manufactured.

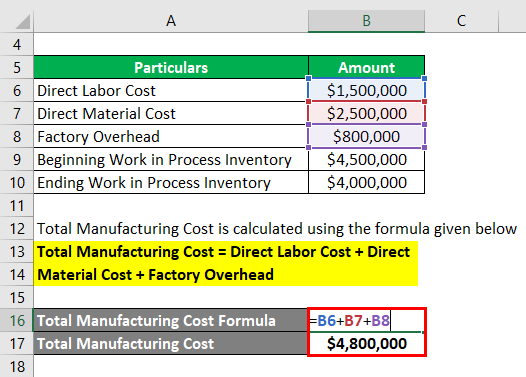

Manufacturing Costs 50 million. Use these four steps to compute total manufacturing costs for a product or business. Now heres how you need to calculate the COS for Benedict Company Manufacturers.

We will use these values. The concept is useful for examining the cost structure of a companys. Beginning work in process WIP inventory Total manufacturing cost direct materials labor overhead - Ending WIP inventory COGM.

The cost of goods manufactured is the cost assigned to produced units in an accounting period. First we need to reach the direct labor cost by multiplying. 150000 75000 105000.

With all the pieces into place we can compute the cost of goods sold. This inventory contains any products of goods or services that are in their final form. Then the beginning WIP inventory Cost of goods not finished in the accounting period and ending WIP costs are 35000 and 45000 respectively.

100000 40000 50000 30000 - 60000 160000. Cost of Goods Manufactured COGM is a term used in managerial accounting that refers to a schedule or statement that shows the total. Direct materials direct labor manufacturing overhead total manufacturing cost.

Beginning Work in Process Inventory.

Compute Cost Of Goods Manufactured Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Template Download Free Excel Template

0 Response to "Cost of Goods Manufactured Formula"

Post a Comment